How to Read a Residential Appraisal Report

Whether you are seeking a dwelling appraisal considering you are buying, refinancing, or selling a home, it is important to empathise the information on your home appraisal report.

Many buyers obtain a home appraisal out of obligation and give information technology zilch more than than a cursory glance. Anyone who hopes to be successful at existent estate investing, however, should become comfy with analyzing their report.

What Is an Appraisal Written report?

Unlike home inspections, the dwelling appraisement is non about looking for safe issues and potential system problems. The licensed, unbiased tertiary-party appraiser is at that place to determine the value of the property.

Y'all tin download the appraisal report we used to create this tutorial here. We will attempt to create a tutorial below for each section of it.

When assessing the value of real manor, there are four elements to consider: need, utility, transferability, and scarcity. An appraiser can use iii principal approaches to appraise how your abode meets these iv requirements. The approach depends heavily on the purpose of the belongings.

Appraisals for residential homes typically utilise the sales comparison approach (sometimes called market data analysis). This arroyo factors in the location and compares the value of other homes in the area.

For special-employ properties such as churches and schools, the cost replacement approach is used. This approach considers how much it would cost to completely rebuild that belongings and bases its value on the replacement cost.

Another arroyo is the income capitalization approach, which bases the value on the income the holding volition generate. This approach is probable to be applied for an investment property.

Understanding the 1004 Class

If yous are applying for a mortgage or refinancing your home, your appraiser volition most probable apply the Uniform Residential Appraisal Report (1004 form). This form covers all the key components that are essential to determining the property value.

While it may not be the nigh exciting reading fabric, getting familiar with each department will help you get a ameliorate investor.

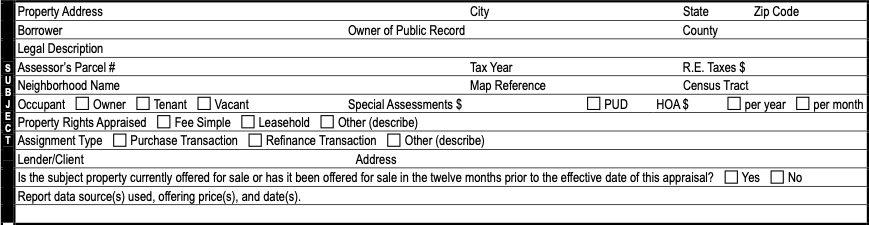

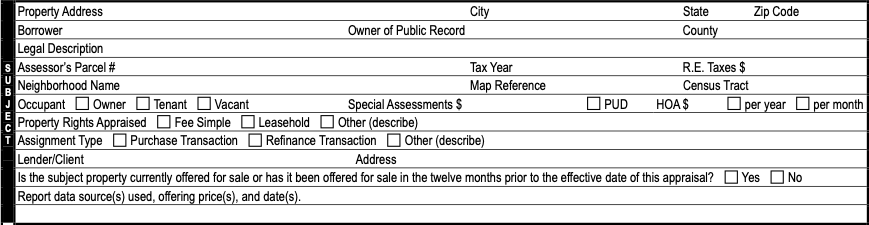

Subject field

The get-go section of the 1004 (oft called the "ten oh four form") is titled "Bailiwick," and it contains information about the borrower. Information technology covers whether the owner of the property has full ownership, who occupies the belongings, and the reason for the appraisal.

The type of assessment to be done tin vary depending on whether this is a purchase transaction or a refinance transaction, then those details are noted in this section too.

Contract

The next section is titled "Contract," and it covers important details of the contract similar the fiscal details. The appraiser will verify they have read the contract and add the contract amount to the written report. This is the part of the written report where any fiscal assistance will be specified.

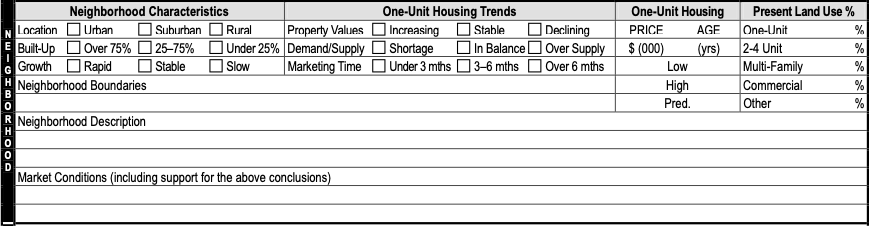

Neighborhood

The third section is titled "Neighborhood," and this is the area where the value of the property is assessed. Is the property location considered urban, suburban, or rural? Is the neighborhood upwardly or downwardly mobile? What is the demand for homes in this location?

An appraiser may take a spin effectually the neighborhood and quickly assess similar homes. Home values tin can be micro-local and vary wildly from one street to the next, so it is ideal to accept an appraiser who is very familiar with the surface area. Other things to examine are the quality of the school district, the law-breaking rate, and the walkability of the location.

The condition of the surrounding homes is considered; presentable neighborhoods generate a higher value for your home. It is a sad reality that you lot tin purchase a home when an area is thriving and so, due to external factors, the surrounding area tin can deteriorate.

When a property loses value due to its neighborhood becoming undesirable, it is called "economical obsolescence." This is the worst fear of many investors who've held on to their investment long term.

Be sure to do thorough research on any prospective investment's location and pay attention to trends in the area. If local businesses are closing downward and crime is rising, it may exist all-time to look elsewhere.

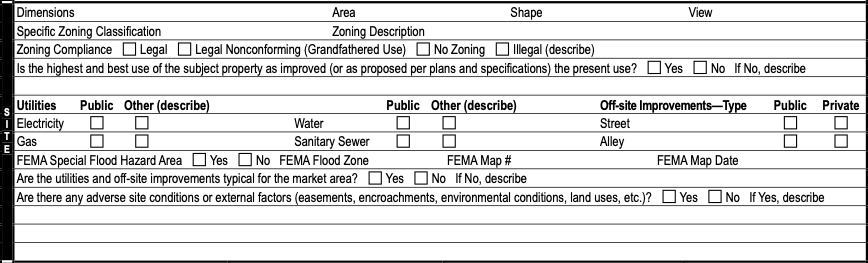

Site

The appraiser will also record the zoning classification and clarification in the section titled "Site." What utilities the property is zoned for, the intended utilize of the belongings, and its current use are also noted in this department. The focus here is that the property fits legal use.

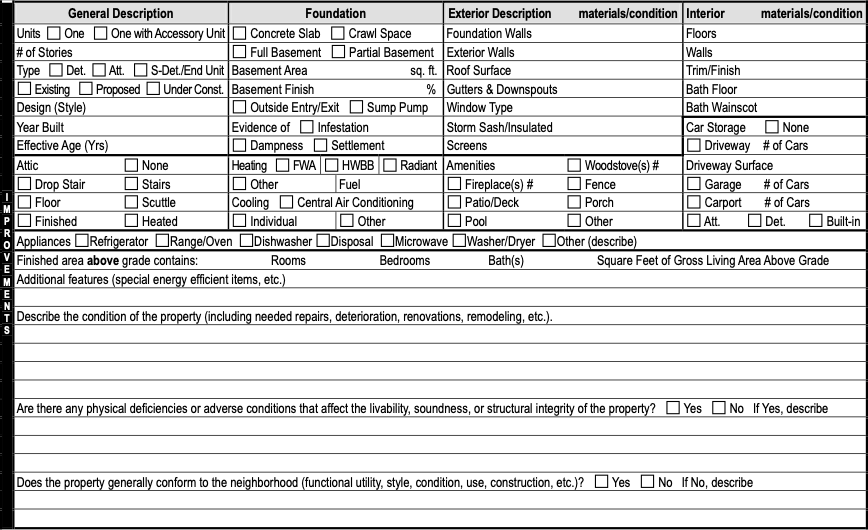

Improvements

In the "Improvements" department, the features of the property are noted, forth with whatever improvements or additions that have been done. While improvements and civilities may add to your enjoyment of your home, don't expect them to automatically improve your belongings value.

You know that fancy new pool you insisted on adding to the lawn? It may exist meaningless when it comes to your report. The value of upgrades are in the heart of the beholder and may exist of little involvement to a prospective buyer. Your upkeep of home maintenance is already expected and whether the material you used was high or depression quality matters piddling.

Decor and style are likewise inconsequential as trends changes rapidly. The condition of the property, repairs needed, and adverse conditions that may bear upon the structure are the main concerns in this section of the written report.

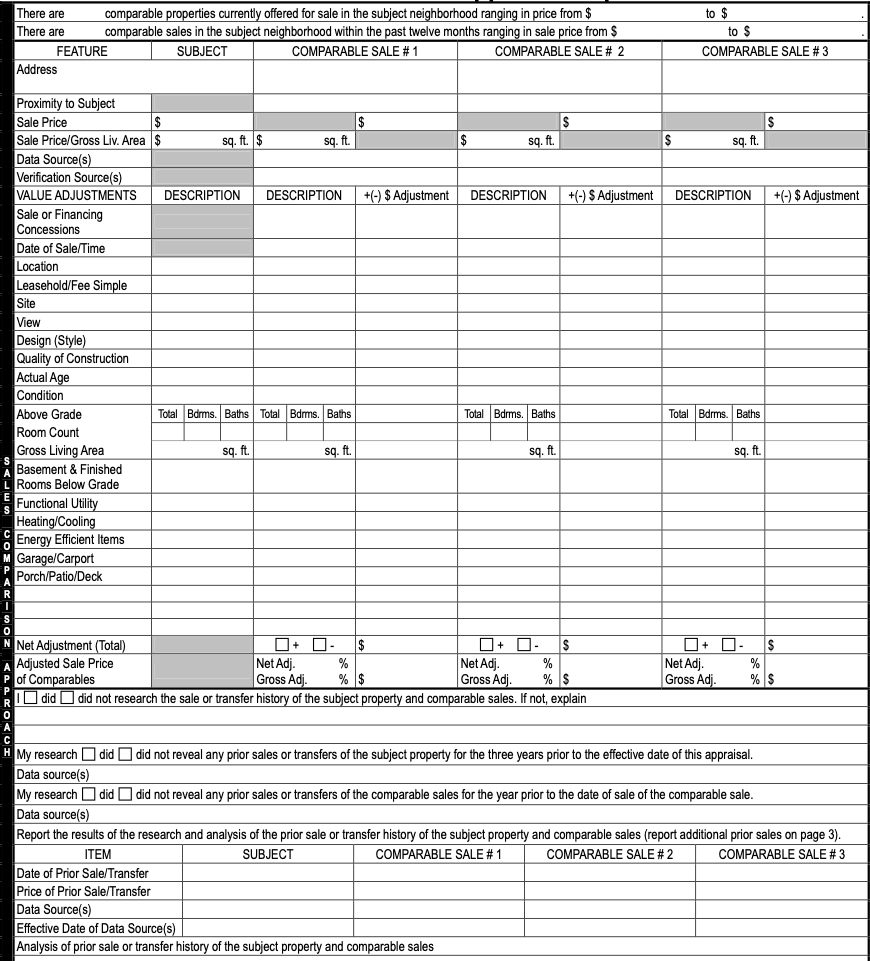

Sales Comparison Approach

On the next folio, there is a department for the appraiser to list at least three backdrop that are like to your habitation. They must exist located within a close radius and take been sold recently. To become the most accurate comparing, Forest Selby of The Firehill Grouping recommends that comparable properties from within the same geographic location should have sold within the last 30-xc days.

The appraiser volition research other properties in the surface area that are comparable to yours, adjusting whatsoever differentials, and this information volition be applied to the report. Recent appraisals for similar homes in the surface area volition be helpful if available in the county's Record of Deeds. Official records are the best data source for comparable properties because, different Zillow and other list sites, information cannot be added by only anyone.

While Zillow can be a great starting point for appraisal research, most professionals adopt to stick to official assessments recorded with the county. If an appraiser is using the sales comparing approach simply cannot find any similar sales for comparable backdrop, they will accept to employ the cost replacement approach.

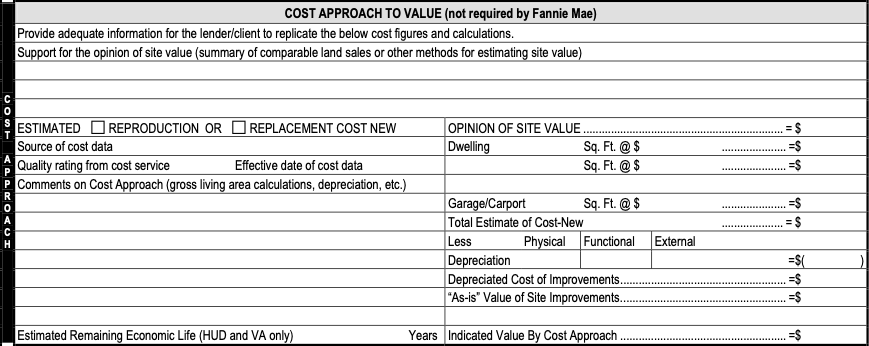

Toll Replacement Approach

The cost replacement approach has a modest department on the written report, and an appraiser may or may not choose to fill information technology in. If this approach is used, the appraiser will examine exactly how much it would cost to build the domicile or edifice if it had to be replaced.

No comparisons are used for this approach. Information technology is a common arroyo to use for properties that are one of a kind or very sometime and therefore do non have easy comparisons.

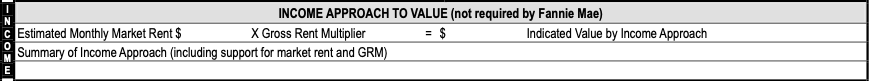

Income Capitalization Approach

The income capitalization approach is the next section and, while not required past almost mortgage companies, information technology is valuable to many investors. It calculates the potential monthly income of a property based on current market data.

If you purchase a home for $100,000 and you charge $1,000 per month in hire, you will split up 100,000 past 1,000 to find your monthly gross rent multiplier, which is 100. To detect your annual gross rent multiplier, but multiply $ane,000 past 12 months, divide 12,000 into 100,000, and your gross hire multiplier is 8.three.

This information is important for rental properties, and so many investors require this section to be filled out for their report. There is an additional field for PUD homes and, if applicable, this is where the specifics of the homeowners clan would be noted.

Appraisal Results

If all goes well, your appraisal will come back at or above value "as is." This means they have reached the value based on the condition the property is currently in.

Information technology may come back as "subject to." In this case, the appraiser has given you the value of your property factoring in some improvements that you must make. Once y'all have made these improvements, your home volition be valued at the amount specified.

If you believe that the value of your appraisement is incorrect, you tin dispute the effect by sending a afterthought of value asking letter to your lender. Incorrect values can occur when the comparable backdrop were not adequate, especially if the appraiser is not familiar with the area.

Contingencies can be useful if prepare alee of time. For example, you as the buyer can concur prior to the cess that if the value comes back lower than the negotiated buy price, you are released from the deal.

It typically takes about a week for the appraiser to consummate the written report of your habitation'south value. Regardless of the reason you are having the appraisal done, it is of import that yous continue a re-create of the study for your records. It ensures that negotiations and discussions volition be fair to all parties and is a tangible representation of your investment.

Source: https://propertyonion.com/education/how-do-you-read-an-appraisal-report/

0 Response to "How to Read a Residential Appraisal Report"

Post a Comment